financial brands

-

16 easy ways to make commercial customers feel like rock stars

Are you making yourself indispensable to your business customers? Treat them like rock stars and they’ll have little reason to consider doing business with other institutions.

Are you making yourself indispensable to your business customers? Treat them like rock stars and they’ll have little reason to consider doing business with other institutions.You don't have to stock their offices with M&M's (minus a certain color) and a special brand of sparkling water.

-

3 ways you can take your customer service from good to incredible

Here you are: Sensational Mr. or Ms. Business Person. But the sad truth is, if your company is selling a product or service, it's probably viewed by customers as a commodity they can get anywhere.

Here you are: Sensational Mr. or Ms. Business Person. But the sad truth is, if your company is selling a product or service, it's probably viewed by customers as a commodity they can get anywhere. -

4 tips to spark board engagement

Your board meets regularly. Maybe they sign loan approvals or give advice. Do they do anything else for you? What about growing your organization? It's time to amp up expectations.

Your board meets regularly. Maybe they sign loan approvals or give advice. Do they do anything else for you? What about growing your organization? It's time to amp up expectations.Whether you’re working with a governing board or an advisory board, here are a few simple steps to spark more engagement from your board of directors and boost your business development program.

-

Bankers: how excellent service devalues your brand

I recently asked a variety of C-level people how often they were called on by a banker trying to get their business. I heard one thing that surprised me—and it’s not what you think.

I recently asked a variety of C-level people how often they were called on by a banker trying to get their business. I heard one thing that surprised me—and it’s not what you think.Several said they don’t really need a loan, so they weren’t that interested in talking to a banker. Wait. What?!

-

Better business development starts with heartburn

When a business development team gets charged up and ready to call on prospects, they’re often so eager to talk, they forget to find out about what’s keeping the prospect up at night.

When a business development team gets charged up and ready to call on prospects, they’re often so eager to talk, they forget to find out about what’s keeping the prospect up at night.Leading with what you have to offer is wasting that precious appointment you finally booked. Start with your prospect's pain and you'll have a much more productive conversation.

-

Better business development starts with heartburn: part 2

When a bank's business development team gets charged up and ready to call on prospects, they’re often so eager to talk, they forget to find out about what’s keeping the prospect up at night. "Me, me, me!", they say. Don't be that guy.

When a bank's business development team gets charged up and ready to call on prospects, they’re often so eager to talk, they forget to find out about what’s keeping the prospect up at night. "Me, me, me!", they say. Don't be that guy. -

Blending cultures in a merger–3 lessons from the Brady Bunch

Mergers and acquisitions are increasingly commonplace in the financial industry. So if your institution is joining or acquiring another, what do you do to ensure a perfectly blended culture that leads to consistent brand and customer experience at all branches?

Mergers and acquisitions are increasingly commonplace in the financial industry. So if your institution is joining or acquiring another, what do you do to ensure a perfectly blended culture that leads to consistent brand and customer experience at all branches?Look no further than the '70s-era TV show, the Brady Bunch for inspiration. Here are 3 takeaways you can use to get started.

-

Business spaghetti: stop waiting to see what sticks

"Things change so fast, there's no room for a plan," we've heard more than once—from more than one CEO. They don't want to be tied down, so they throw out random tactics and wait to see what sticks. Here are 3 ways to be ready for change while still working a smart plan for your brand.

"Things change so fast, there's no room for a plan," we've heard more than once—from more than one CEO. They don't want to be tied down, so they throw out random tactics and wait to see what sticks. Here are 3 ways to be ready for change while still working a smart plan for your brand. -

Do not write my name on my clothes: and other things you do for your convenience, not mine

It’s been a while, but I’m still fuming about the dry cleaner who wrote my name inside my clothes. With a Sharpie. Really!? This isn’t summer camp and I’m not 8 years old.

It’s been a while, but I’m still fuming about the dry cleaner who wrote my name inside my clothes. With a Sharpie. Really!? This isn’t summer camp and I’m not 8 years old.While this happened months ago, I’m still dismayed.

-

Do you live your slogan, or are you a copycat bank?

Nearly every financial institution has a slogan. They believe it helps set them apart from competitors. And they think it’s a key part of their brand. While that may be so, we see two big problems with a majority of these slogans: 1) they don't truly differentiate, and 2) there’s no real support behind the promise.

Nearly every financial institution has a slogan. They believe it helps set them apart from competitors. And they think it’s a key part of their brand. While that may be so, we see two big problems with a majority of these slogans: 1) they don't truly differentiate, and 2) there’s no real support behind the promise. -

Don't "nice" your institution out of profitability

A bank president recently told me he lets safe deposit box rent renewal notices slide because he hates to bug people over something so small, and he wants to be nice.

A bank president recently told me he lets safe deposit box rent renewal notices slide because he hates to bug people over something so small, and he wants to be nice.It made me wonder whether he’s nice or just afraid to risk irritating a customer over a relatively small fee.

-

Don't leave employees (and customers) in the dark

Everyone is busy. Like many high-performing employees, your people may be running as fast as they can. The problem: somewhere along the line, they’ve been taught to mind their own book of business, not the business of the entire bank. They're in the dark.

Everyone is busy. Like many high-performing employees, your people may be running as fast as they can. The problem: somewhere along the line, they’ve been taught to mind their own book of business, not the business of the entire bank. They're in the dark. -

Environmental Branding for Total Brand Immersion

Creating a powerful brand experience goes far beyond having a sign outside and welcome mat at the front door. It's about expressing the brand's personality and promise everywhere. Read on for ways your environment can get your brand off the B list.

Creating a powerful brand experience goes far beyond having a sign outside and welcome mat at the front door. It's about expressing the brand's personality and promise everywhere. Read on for ways your environment can get your brand off the B list. -

Environmental Branding: True Brand Immersion

Creating a powerful brand experience goes far beyond having a sign outside and welcome mat at the front door. It's about expressing the brand's personality and promise everywhere. Read on for ways your environment can get your brand off the B list.

Creating a powerful brand experience goes far beyond having a sign outside and welcome mat at the front door. It's about expressing the brand's personality and promise everywhere. Read on for ways your environment can get your brand off the B list. -

Finding the Financial Forest in the Trees

Sometimes when you’re working in the business instead of on the business, you lose sight of the big picture. You become so embedded in the details, the view is myopic. You’re dealing with trees when you should be managing the forest.

Sometimes when you’re working in the business instead of on the business, you lose sight of the big picture. You become so embedded in the details, the view is myopic. You’re dealing with trees when you should be managing the forest. -

First national banks are confusing the heck out of us

When I was a new college freshman, a classmate who was also from out of town attempted to make a deposit in the local “first national bank.” It wasn’t the same “first national” that she had at home, but she hadn’t realized that. Some big confusion about her account ensued.

When I was a new college freshman, a classmate who was also from out of town attempted to make a deposit in the local “first national bank.” It wasn’t the same “first national” that she had at home, but she hadn’t realized that. Some big confusion about her account ensued. -

How a hound dog and a handshake bred enduring loyalty

My 93-year-old father-in-law Ralph is a WWII veteran and serial entrepreneur. Over the years, he’s owned a night club, a dry cleaning shop, a demolition business—and more. He’s an excellent negotiator and he knows how to lead and inspire a team.

My 93-year-old father-in-law Ralph is a WWII veteran and serial entrepreneur. Over the years, he’s owned a night club, a dry cleaning shop, a demolition business—and more. He’s an excellent negotiator and he knows how to lead and inspire a team.And he knows first-hand the value of a strong banking relationship.

-

How to pay more than lip service to your brand

Many financial institutions struggle with differentiating themselves in this commodity-mindset industry. “We need a new slogan,” they say. And, “let’s talk about our great service.”

Many financial institutions struggle with differentiating themselves in this commodity-mindset industry. “We need a new slogan,” they say. And, “let’s talk about our great service.”Service is not a position and you’ve got to pay more than lip service to your brand.

-

I make a mistake, I pay. You make a mistake, I pay?!

I talk about banking with a lot of people. So last month, someone told me about accidentally hitting “submit” on an ACH twice. Fortunately, a banker called right away to inquire about whether it was a duplicate and got it reversed. There was a $30+ charge for that fix, but it saved some money and hassle in the long run.

I talk about banking with a lot of people. So last month, someone told me about accidentally hitting “submit” on an ACH twice. Fortunately, a banker called right away to inquire about whether it was a duplicate and got it reversed. There was a $30+ charge for that fix, but it saved some money and hassle in the long run.Now, compare that to an accident the bank made on this same company’s credit card accounts.

-

Make your customers look good to their customers and win at customer loyalty

Many community financial institutions say they’re customer-centric, yet have a brand promise too focused on the bank. What if your brand difference is about helping your customers win with their customers?

Many community financial institutions say they’re customer-centric, yet have a brand promise too focused on the bank. What if your brand difference is about helping your customers win with their customers?That would merit some roaring fans. Here's how:

-

Marketing minimalism can create large ripples

Doing the minimum.

Doing the minimum.This has such a negative connotation in our culture, but what if you embraced that concept? What’s the minimum you need to do in order to create the desired impact or change?

-

Shhhh! Stop using the *S* word.

Many community bankers struggle with getting all of their staffers to feel confident with business development. That’s because staffers are afraid of the *S* word.

Many community bankers struggle with getting all of their staffers to feel confident with business development. That’s because staffers are afraid of the *S* word.Don’t tell them to SELL, teach them to LISTEN.

Use our “Business and Baby” rule as your internal rallying cry.

-

Stop calling on the usual suspects for your advisory board

Lots of community banks have an advisory board of 8-10 local movers and shakers. Some of these boards have diverse representation. Unfortunately, many are filled the usual suspects. If you want to stand the test of time, you must attract and retain the next generation of movers and shakers.

-

Stop hiring tellers—you need listeners

The moniker “teller” has been around in banking since time immemorial. And while it may feel comfortable to you, it sends unintended messages. It positions banker relationships as one-sided—with the bankers holding all the power—and the customer taking what’s doled out.

You can be better. Here are 3 ways to get started:

-

Strategic alliances can multiply your reach—and your value—to customers

When was the last time you thought about putting your well-known contacts and customers together to bring more value to everyone? As a banker, you know lots of people. Are you using that knowledge to expand your reach?

-

Sweet 16: a (brand) new year is here

Though this week heralds the arrival of a brand new year, we’ll be making resolutions for 2017 before we know it.

Though this week heralds the arrival of a brand new year, we’ll be making resolutions for 2017 before we know it.Don't let 2016 slip away because you were too busy.

Here are 16 strategies for a stronger, more profitable brand.

-

Sweet 16: strategies for the (brand) new year

Though this week heralds the arrival of a brand new year, we’ll be making resolutions for 2017 before we know it.

Though this week heralds the arrival of a brand new year, we’ll be making resolutions for 2017 before we know it.Don't let 2016 slip away because you were busy.

Here are 16 strategies for a stronger, more profitable brand.

-

The surprisingly effective response to a customer complaint

I recently had trouble with a community bank’s technology and emailed a banker there to complain in what I hope was a polite—but very frustrated—manner. The response was swift and unexpected.

I recently had trouble with a community bank’s technology and emailed a banker there to complain in what I hope was a polite—but very frustrated—manner. The response was swift and unexpected.She thanked me.

-

What bankers can learn from Girl Scouts about customer experience

Soon, Girl Scout Cookie Time will return. Over the years you’ve come to expect—and thoroughly enjoy—your purchase experience. Whether your favorite is Thin Mints or Samoas, you might think the cookies are a little pricey. And you also think they’re worth every indulgent bite.

Soon, Girl Scout Cookie Time will return. Over the years you’ve come to expect—and thoroughly enjoy—your purchase experience. Whether your favorite is Thin Mints or Samoas, you might think the cookies are a little pricey. And you also think they’re worth every indulgent bite. -

What Dale Carnegie and Beyoncé can teach bankers about relationships

Almost every community bank will boast that they know their customers by their names. But do you really?

Almost every community bank will boast that they know their customers by their names. But do you really?And do you teach your bankers to go further than just recognizing familiar faces and say customers' names out loud? It might be a little old school - but it will be music to their ears.

-

What tourist-y restaurants can teach banks about being sticky

I was a tourist in Branson, MO recently and as to be expected, had some sub-par experiences in the crowded restaurants. Many seemed perfectly happy offering mediocre food and sticky seats. They know I probably won’t be back, because some other stranger will take my place. They're just in it for today's dollar.

I was a tourist in Branson, MO recently and as to be expected, had some sub-par experiences in the crowded restaurants. Many seemed perfectly happy offering mediocre food and sticky seats. They know I probably won’t be back, because some other stranger will take my place. They're just in it for today's dollar.On the flip side, you actually want stickiness in your institution. You're in it for today's and tomorrow's dollars.

-

What’s green and goes round and round all day?

Your first answer might conjure playground riddles from first grade: a frog in a blender. But it also might be the answer to a common struggle for merging institutions: their advisory boards.

Your first answer might conjure playground riddles from first grade: a frog in a blender. But it also might be the answer to a common struggle for merging institutions: their advisory boards.Without proper planning and an intentional effort, blending cultures of two advisory boards may cause things to “go round all day.”

-

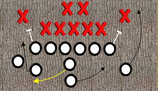

Why your officer calling program is destined to fail

You have new marketing brochures, a fantastic iPad sales presentation and you’re ready to turn your bankers loose. You're certain this is the time they’ll get out there and land some shiny new relationships.

Will they do it? Or are you going to be disappointed again? Here are 3 reasons your campaign is destined to fail—and how to fix it.

-

You're not making it easy for me to do business with you

Dear Community Banker X: Your technology is behind. Your ATM is dysfunctional and you don’t seem to care whether I can easily do business with you or not. I’m sending out an SOS.

Dear Community Banker X: Your technology is behind. Your ATM is dysfunctional and you don’t seem to care whether I can easily do business with you or not. I’m sending out an SOS.