customer service

-

"Not a problem" for lazy brands—and what to do about it

“Not a problem,” the customer service person said to me on the phone as we were wrapping up my transaction. What!? Not a problem? For who—you!? Wait a minute. Who is the customer here?

“Not a problem,” the customer service person said to me on the phone as we were wrapping up my transaction. What!? Not a problem? For who—you!? Wait a minute. Who is the customer here? -

16 easy ways to make commercial customers feel like rock stars

Are you making yourself indispensable to your business customers? Treat them like rock stars and they’ll have little reason to consider doing business with other institutions.

Are you making yourself indispensable to your business customers? Treat them like rock stars and they’ll have little reason to consider doing business with other institutions.You don't have to stock their offices with M&M's (minus a certain color) and a special brand of sparkling water.

-

3 kinds of hoarding that smother your brand

Look into the proverbial closet of your organization. Chances are, there are a few habits or tactics you know you need to give up—but for some reason, just can’t. Worst case scenario: you have a vast store house that needs to be purged.

Look into the proverbial closet of your organization. Chances are, there are a few habits or tactics you know you need to give up—but for some reason, just can’t. Worst case scenario: you have a vast store house that needs to be purged.What’s still hanging around is weighing you down. It's a sign of sickness that needs immediate intervention.

-

3 ways you can take your customer service from good to incredible

Here you are: Sensational Mr. or Ms. Business Person. But the sad truth is, if your company is selling a product or service, it's probably viewed by customers as a commodity they can get anywhere.

Here you are: Sensational Mr. or Ms. Business Person. But the sad truth is, if your company is selling a product or service, it's probably viewed by customers as a commodity they can get anywhere. -

Banish the skeletons in your brand closet

Branders often overlook or ignore things that can have a big impact on the impressions they make on their customers. Case in point: the coat closet.

Branders often overlook or ignore things that can have a big impact on the impressions they make on their customers. Case in point: the coat closet.Some organizations inadvertantly leave others with a bad taste in their mouths over their closets—or lack thereof. Here's why:

-

Bankers: how excellent service devalues your brand

I recently asked a variety of C-level people how often they were called on by a banker trying to get their business. I heard one thing that surprised me—and it’s not what you think.

I recently asked a variety of C-level people how often they were called on by a banker trying to get their business. I heard one thing that surprised me—and it’s not what you think.Several said they don’t really need a loan, so they weren’t that interested in talking to a banker. Wait. What?!

-

Branders: stop shouting and start listening

The strongest brands on earth have a two-sided relationship with their fans. Like any real life relationship, there’s give and take. Speaking and listening.

The strongest brands on earth have a two-sided relationship with their fans. Like any real life relationship, there’s give and take. Speaking and listening.If you’re only focused on advertising, posting, tweeting and shouting, you’re going to miss what people say—and think—about your brand.

-

Branders: take that foot out of your mouth

The starlet (insert name) was stunningly beautiful—until she opened her mouth and became a devastating disappointment to her fans. Her foot will be removed from her mouth with the help of a good PR agent.

The starlet (insert name) was stunningly beautiful—until she opened her mouth and became a devastating disappointment to her fans. Her foot will be removed from her mouth with the help of a good PR agent.Branders: it’s harder for you. You have numerous people who can make your brand look dazzling—or like Hollywood’s biggest trainwreck.

-

Dear Valued Customer

"Dear Valued Customer,"

"Dear Valued Customer,"I recently received an email with this salutation from a company where I spent a significant amount of money about two years ago. They wanted to see if I needed more of their services. They even referenced a survey that I had “recently” filled out—but actually had done more than a year ago.

-

Do I have that "new customer" smell?

Or have you gotten used to me? Every employee at every institution should be sniffing out new ways to help me as a customer—and build the business.

Or have you gotten used to me? Every employee at every institution should be sniffing out new ways to help me as a customer—and build the business.I recently visited a bank that is making a deliberate shift to a sales culture.

-

Do not write my name on my clothes: and other things you do for your convenience, not mine

It’s been a while, but I’m still fuming about the dry cleaner who wrote my name inside my clothes. With a Sharpie. Really!? This isn’t summer camp and I’m not 8 years old.

It’s been a while, but I’m still fuming about the dry cleaner who wrote my name inside my clothes. With a Sharpie. Really!? This isn’t summer camp and I’m not 8 years old.While this happened months ago, I’m still dismayed.

-

Don't "nice" your institution out of profitability

A bank president recently told me he lets safe deposit box rent renewal notices slide because he hates to bug people over something so small, and he wants to be nice.

A bank president recently told me he lets safe deposit box rent renewal notices slide because he hates to bug people over something so small, and he wants to be nice.It made me wonder whether he’s nice or just afraid to risk irritating a customer over a relatively small fee.

-

Don't take the person out of personal service

I don’t know whether it’s today’s consumer online habits or a lack of training. But I do know I don’t like it. “What’s the name?” the receptionist blankly asked me at my doctor’s office this week. Ick. There seems to be an epidemic of taking the person out of personal service.

I don’t know whether it’s today’s consumer online habits or a lack of training. But I do know I don’t like it. “What’s the name?” the receptionist blankly asked me at my doctor’s office this week. Ick. There seems to be an epidemic of taking the person out of personal service. -

Friction leads to frustration: 3 simple fixes to improve customer experience

Marketers polish their brands to a high gloss shine. Every word, color and font carefully honed to perfection. When marketing works effectively, leads are generated and new customers come in the door, call or go to your website.

Marketers polish their brands to a high gloss shine. Every word, color and font carefully honed to perfection. When marketing works effectively, leads are generated and new customers come in the door, call or go to your website.But these victories won’t do you any good if the customer experience falls short.

-

How a hound dog and a handshake bred enduring loyalty

My 93-year-old father-in-law Ralph is a WWII veteran and serial entrepreneur. Over the years, he’s owned a night club, a dry cleaning shop, a demolition business—and more. He’s an excellent negotiator and he knows how to lead and inspire a team.

My 93-year-old father-in-law Ralph is a WWII veteran and serial entrepreneur. Over the years, he’s owned a night club, a dry cleaning shop, a demolition business—and more. He’s an excellent negotiator and he knows how to lead and inspire a team.And he knows first-hand the value of a strong banking relationship.

-

How gossip amplifies (or muffles) your brand

Amazon Chairman Jeff Bezos has famously said, “Your brand is what people say about you when you’re not in the room.”

Amazon Chairman Jeff Bezos has famously said, “Your brand is what people say about you when you’re not in the room.”If you take this to heart, you need to understand all the people who talk about you when you’re not in the room.

-

I make a mistake, I pay. You make a mistake, I pay?!

I talk about banking with a lot of people. So last month, someone told me about accidentally hitting “submit” on an ACH twice. Fortunately, a banker called right away to inquire about whether it was a duplicate and got it reversed. There was a $30+ charge for that fix, but it saved some money and hassle in the long run.

I talk about banking with a lot of people. So last month, someone told me about accidentally hitting “submit” on an ACH twice. Fortunately, a banker called right away to inquire about whether it was a duplicate and got it reversed. There was a $30+ charge for that fix, but it saved some money and hassle in the long run.Now, compare that to an accident the bank made on this same company’s credit card accounts.

-

Is your brand as appreciated as an extra button?

Why should you be an “extra button” brand? The extra button brand is the one who gets a customer by when he’s in a pinch. It's the brand that helps a customer save face. It's the brand that has your back.

Why should you be an “extra button” brand? The extra button brand is the one who gets a customer by when he’s in a pinch. It's the brand that helps a customer save face. It's the brand that has your back.Deliver that kind of service, and you’re the life saver that builds unquestionable loyalty.

-

Make your customers look good to their customers and win at customer loyalty

Many community financial institutions say they’re customer-centric, yet have a brand promise too focused on the bank. What if your brand difference is about helping your customers win with their customers?

Many community financial institutions say they’re customer-centric, yet have a brand promise too focused on the bank. What if your brand difference is about helping your customers win with their customers?That would merit some roaring fans. Here's how:

-

Pardon me, but your slip is showing

Occasionally a slip-up can make your brand look bruised. More than one can make it smell rotten. Your competitors may find it as entertaining as a Marx Brothers sketch. You won't.

Occasionally a slip-up can make your brand look bruised. More than one can make it smell rotten. Your competitors may find it as entertaining as a Marx Brothers sketch. You won't.Here are some trouble spots to look out for—and what to do about them.

-

Shhhh! Stop using the *S* word.

Many community bankers struggle with getting all of their staffers to feel confident with business development. That’s because staffers are afraid of the *S* word.

Many community bankers struggle with getting all of their staffers to feel confident with business development. That’s because staffers are afraid of the *S* word.Don’t tell them to SELL, teach them to LISTEN.

Use our “Business and Baby” rule as your internal rallying cry.

-

Stop hiring tellers—you need listeners

The moniker “teller” has been around in banking since time immemorial. And while it may feel comfortable to you, it sends unintended messages. It positions banker relationships as one-sided—with the bankers holding all the power—and the customer taking what’s doled out.

You can be better. Here are 3 ways to get started:

-

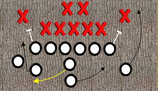

Stop talking about a sales funnel and think of it as a chain instead

Old school sales guys will tell you sales is just a numbers game. Get enough prospects into the funnel and they’ll dump out X% of customers at the bottom. Easy.

Old school sales guys will tell you sales is just a numbers game. Get enough prospects into the funnel and they’ll dump out X% of customers at the bottom. Easy.News flash, Herb Tarlek: your lack of a system is as outdated as your plaid polyester coat.

-

Strategic alliances can multiply your reach—and your value—to customers

When was the last time you thought about putting your well-known contacts and customers together to bring more value to everyone? As a banker, you know lots of people. Are you using that knowledge to expand your reach?

-

The surprisingly effective response to a customer complaint

I recently had trouble with a community bank’s technology and emailed a banker there to complain in what I hope was a polite—but very frustrated—manner. The response was swift and unexpected.

I recently had trouble with a community bank’s technology and emailed a banker there to complain in what I hope was a polite—but very frustrated—manner. The response was swift and unexpected.She thanked me.

-

What bankers can learn from Girl Scouts about customer experience

Soon, Girl Scout Cookie Time will return. Over the years you’ve come to expect—and thoroughly enjoy—your purchase experience. Whether your favorite is Thin Mints or Samoas, you might think the cookies are a little pricey. And you also think they’re worth every indulgent bite.

Soon, Girl Scout Cookie Time will return. Over the years you’ve come to expect—and thoroughly enjoy—your purchase experience. Whether your favorite is Thin Mints or Samoas, you might think the cookies are a little pricey. And you also think they’re worth every indulgent bite. -

What Dale Carnegie and Beyoncé can teach bankers about relationships

Almost every community bank will boast that they know their customers by their names. But do you really?

Almost every community bank will boast that they know their customers by their names. But do you really?And do you teach your bankers to go further than just recognizing familiar faces and say customers' names out loud? It might be a little old school - but it will be music to their ears.

-

What tourist-y restaurants can teach banks about being sticky

I was a tourist in Branson, MO recently and as to be expected, had some sub-par experiences in the crowded restaurants. Many seemed perfectly happy offering mediocre food and sticky seats. They know I probably won’t be back, because some other stranger will take my place. They're just in it for today's dollar.

I was a tourist in Branson, MO recently and as to be expected, had some sub-par experiences in the crowded restaurants. Many seemed perfectly happy offering mediocre food and sticky seats. They know I probably won’t be back, because some other stranger will take my place. They're just in it for today's dollar.On the flip side, you actually want stickiness in your institution. You're in it for today's and tomorrow's dollars.

-

You're not making it easy for me to do business with you

Dear Community Banker X: Your technology is behind. Your ATM is dysfunctional and you don’t seem to care whether I can easily do business with you or not. I’m sending out an SOS.

Dear Community Banker X: Your technology is behind. Your ATM is dysfunctional and you don’t seem to care whether I can easily do business with you or not. I’m sending out an SOS.